COVID could have a lasting impact on radio listening habits. The latest TechSurvey from Jacobs Media offers a glimpse at how shifting radio listening patterns developed during the pandemic have affected radio broadcasters.

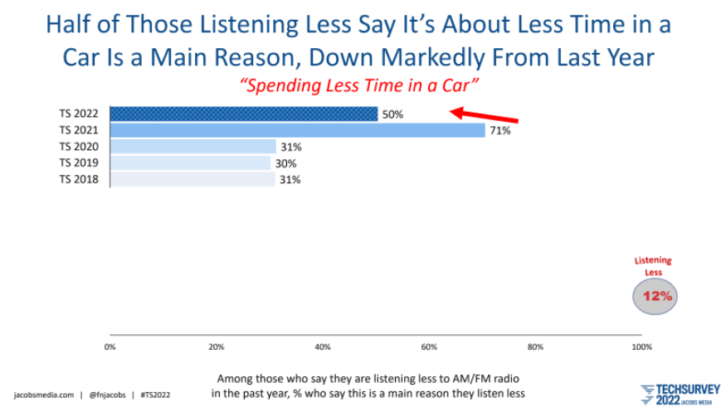

A key finding from TechSurvey 2022 shows that 12% of core radio users say they are listening to broadcast radio less in the last year, mostly because they spend less time in the car.

TechSurvey respondents typically list items like “too many commercials” and “repetitive music” as top reasons they listen less to the radio, but things have changed the past several years, according to the latest survey’s results.

“Since COVID, listening less in the car and lifestyle changes are the top reasons people are listening less to the radio,” said Fred Jacobs, president of Jacobs Media.

Jacobs appeared on the TS 2022 webinar last week and said those lifestyle changes range from working from home − certainly a new option for many − and quitting a job to changing work habits and evolving family obligations. All can impact the amount of time spent listening to the radio, he said.

The highest percent of survey respondents saying they are spending less time in the car are women, Millennials and Baby Boomers, Jacobs said.

The good news is the number of those surveyed who said they listen to less radio because they are in the car less often dipped in the most recent TechSurvey to 50% from a high of 71% in 2021, Jacobs said.

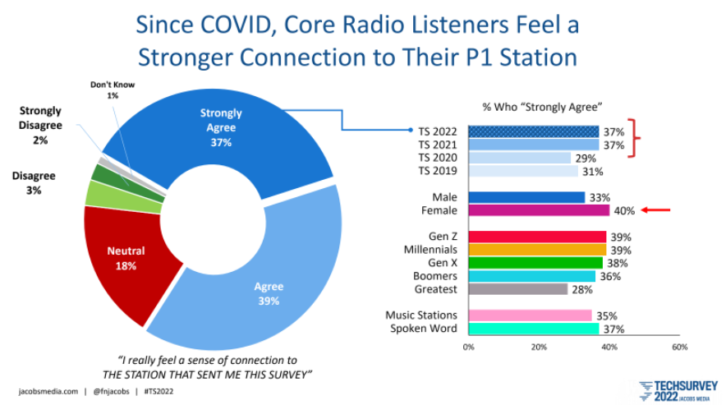

Those core 31,000 radio listeners that participated in TS 2022 mostly agree they have a stronger connection to their P1 station since COVID. About 37% say they strongly agree with that assertion, while 39% agree and 18% remained neutral.

“In a strange sort of way, some radio stations have actually benefitted from COVID in terms of making that closer connection to their audience when they needed it most,” Jacobs said.

The Jacobs’ survey data shows the number those who strongly agree remained at 37% for a second year and more women than men have that opinion.

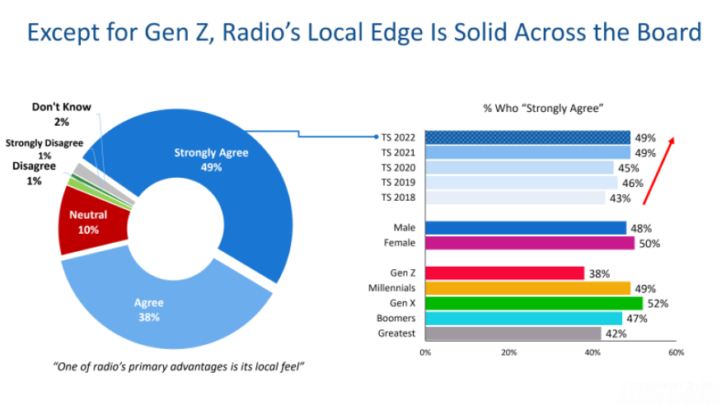

Perhaps even more intriguing is radio’s hold on those core listeners who connect to radio’s “local orientation” during the pandemic. Except for Gen Z, radio’s local edge grew or maintained its edge when it comes to the question of local.

“Overall, the local piece turns out to be a very important factor here,” Jacobs says.

The “agree or disagree question” ranked a high of 49% of those who “strongly agree” the past two surveys. The male/female breakdown is about a wash, Jacobs says, but the strong numbers for Millennials, Gen X and Boomers are noteworthy.

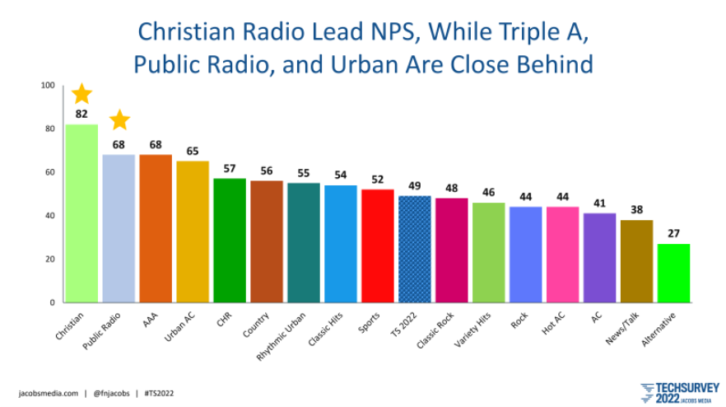

Jacobs goes on to explain the TS 2022’s Net Promoter scores, which measure whether a person would be likely to recommend a particular station to a friend or family member. A snapshot of the data since the very first TechSurvey in 2005 seems to reflect a slowly growing positive trend. In fact, the two best Net Promoter scores for commercial radio have come the past two years, he said.

“Radio’s word-of-mouth numbers are holding strong,” Jacobs said, “led by Christian radio and Public radio formatted stations.”

This is the third in a series of stories examining the results from TechSurvey 2022. Click here to read part two.

Randy J. Stine has spent the past 40 years working in audio production and broadcast radio news. He joined Radio World in 1997 and covers new technology and regulatory issues. He has a B.A. in journalism from Michigan State University.