Radio advertising continues to outpace TV ad effectiveness, especially in the home improvement space, according to a series of studies commissioned over a six-year period.

Over those six years, the Audio Active Group at Cumulus Media-Westwood One commissioned eight consumer studies focusing specifically on the home improvement market.

The findings indicate that radio continues to be effective, efficient and often times the most successful way of boosting brand awareness and bringing shoppers to a home improvement retailer, whether in person or online.

As a start, the studies found that the heaviest users of audio are the biggest drivers of home improvement sales. Among three listener categories — heavy radio listeners, podcast listeners and heavy TV viewers (which would be more than eight hours a week for radio and 24 hours a week for TV) — it turns out that audio consumers, which includes either radio listeners or podcast listeners, turn out to be “massive spenders” in the home improvement category.

[Read: Bouvard: COVID Concerns Are Dropping]

“They spend way more than average, take more shopping trips than others, spend more per trip and are visiting more retailers, said Pierre Bouvard, chief insights officer at the Audioactive Group at Cumulus Media-Westwood One, in a recent explanatory video.

Spending more ad dollars on radio also paid off for home improvement retailers. The studies found that a home improvement retailer that increased spending by more than two times on AM/FM radio in 21 local markets experienced a significant surge in store traffic and sales. In addition, AM/FM radio ads that focus on sales events for different home improvement departments consistently created a halo effect that resulted in increased online shopping and store visits.

Take the example of Home Depot’s May 2021 TV ad campaign. A Nielsen Media Impact analysis said that the home improvement store’s television campaign reached about 50% of the 25– to 49–year-old demographic with its TV campaign. But when the advertiser overlaid a radio campaign on top of TV advertising, the reach jumped 61%, enabling Home Depot to reach 80% of American viewers in that demographic.

Take another home improvement retailer in the same month of May. Their TV campaign reached 2/3 of Americans in the 18– to 24–year-old age group. When a radio ad campaign was added, the incremental reach growth was 27%, allowing this retailer to reach 83% of American viewers in that age group.

“How is this possible? Where is all this incremental reach coming from?” Bouvard said. “Nielsen Media Impact reveals clearly the younger the demographic, the greater the lift in reach growth generated by AM/FM radio.”

The Nielsen numbers showed that 45% more listeners were reached via radio advertising in a Wayfair TV and radio ad campaign in May 2020 that when compared against TV advertising alone.

“Radio really helps build 18–49 incremental reach,” Bouvard said. “This is truly where radio makes your TV better.”

It’s no surprise that shopping during the pandemic shifted with the study revealing that 56% of all adults aged 18 years and older shopped for home improvement goods online in the last year. But those numbers shifted even higher when the study calculated whether the buyers were audio listeners. The study found that 69% of radio listeners and 79% of podcast consumers aged 18 years and older shopped online over the last year.

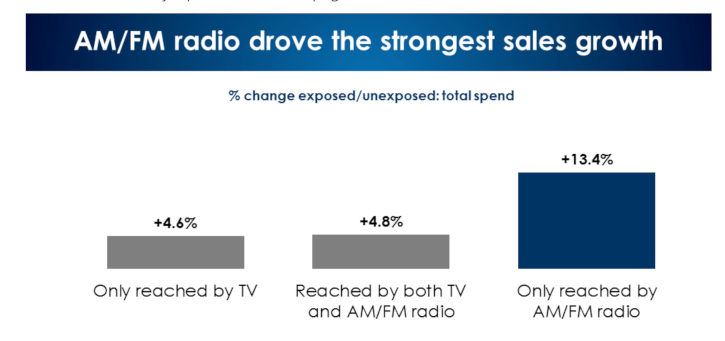

The research also offered other buyer insights too, including the finding that ads with a female voiceover drove stronger brand awareness among both men and women; that for every dollar spent by advertisers on radio advertising, nearly $29 dollars in sales was generated; that the younger the demographic, the greater the reach lift generated by AM/FM radio; and that in some instances, the sales effect of radio is triple that of TV.

The survey offered several recommendations too including that home improvement retailers should increase their AM/FM radio media budgets. “Add AM/FM radio to make home improvement TV campaigns better,” Bouvard said.