Another C-band shakeup is possible.

America’s thirst for wireless services could take another bite of the C-band from satellite companies that use it extensively for radio and television downlinks.

Five years after reallocating the bottom half of the band for wireless use and moving broadcasters’ satellite services to the upper half, the FCC is considering grabbing more of those frequencies.

It opened a notice of inquiry earlier this year to explore opportunities for innovation and investment in the upper C-band (3.98–4.2 GHz).

It invited feedback on options for more intensive use of the upper band that could incentivize rapid deployment of new communications services and spur investment. The commission said it hopes to build on the success of flipping the lower band in 2020 from satellite to flexible wireless use, which it says brought enhanced 5G service to many communities.

The notice is available for review under GN Docket 25-59 in the FCC’s online system.

Observers say Auction 107 for the lower C-band generated $81 billion in net licensing fees.

The FCC reallocated the 3.7–3.98 portion despite protests from radio and TV broadcasters. Following the change, broadcast satellite services had to be moved to the upper portion of the band.

Now users could be faced with moving again, with the FCC apparently working toward holding another public auction. Congress recently restored the commission’s auction authority after a lapse of more than two years.

[Related: “Airwaves Battle Brews Over Upper C-Band”]

The band is a swath of very attractive spectrum, experts say.

The upper band is used by satellite companies like SES and Intelsat to distribute audio and video content to broadcasters and cable systems.

Reimbursement money for satellite companies and other C-band incumbents disrupted by the earlier repack came from proceeds of the auction. Satellite companies were given heavy incentives to speed up the transition.

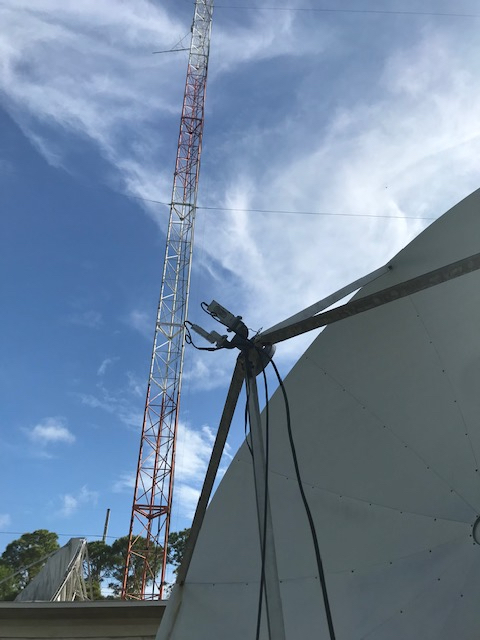

C-band earth stations were affected, with broadcasters obliged to install bandpass filters to block signals from adjacent channels and prevent harmful interference from new flexible-use operations. In some cases broadcasters had to replace satellite dishes.

Broadcasters who registered their earth station terminals prior to the repack were eligible for reimbursement funds.

Going into the first repack, the FCC said there were approximately 20,000 registered earth stations in the contiguous U.S. classified as incumbent earth stations for purposes of the transition. The transition was completed by late 2023.

Less than two years after that migration was completed, the FCC appears hungry to gobble up more spectrum for 5G services. Chairman Brendan Carr has said repeatedly there is a need for a steady pipeline of spectrum to meet ever-increasing consumer demand.

Satellite industry observers told us they are not surprised by the FCC’s latest actions.

When the NOI was released, Carr said “nothing is off the table” when it comes to the upper C-band. He added that he “was pleased the commission is moving forward quickly on spectrum” and that “C-band is a good place to start.”

Mark Johnson, founder of LinkUp Communications, said on a recent webinar produced by the Alabama Broadcasters Association that it’s “pretty clear Carr wants all 200 MHz of the upper C-band for 5G services.”

He said efforts to take more spectrum for 5G have the momentum of “a big rock rolling downhill.”

Broadcast opposition

CTIA is the cellular telecommunications industry association, now led by former FCC Chairman Ajit Pai.

It favors the migration. It has told FCC officials that the success of the earlier auction and transition “was due to favorable characteristics of mid-band airwaves, decisive actions by the FCC and substantial work that myriad stakeholders undertook to rapidly transition and safely deploy the band.”

The upper C-band holds the same promise, CTIA said, urging the commission to open it for full-power terrestrial wireless use.

In demonstrating a united front with the airline industry, CTIA, the Aerospace Industries Association and Airlines for America wrote in an Aug. 21 ex parte filing to the FCC that the U.S. must “maintain its historic leadership in wireless telecommunications and aerospace advancements.”

However, the National Association of Broadcasters has pushed back. It told the FCC it’s not realistic for broadcasters to give up the upper 200 MHz of the band.

“[U]se of the upper C-band for satellite program contribution and distribution is critical to the broadcast industry, and that use has become more intense since the lower C-band auction less than five years ago,” it wrote.

The association says other options — like fiber or satellite operation in the Ku band — are not suitable. In addition, NAB said the wireless industry is painting an exaggerated picture of spectrum saturations to justify further allocation.

“These claims from the wireless industry … of ‘spectrum crisis,’ ‘spectrum shortage’ and ‘spectrum crunch’ repeat hyperbolic contentions of the past,” it wrote.

NAB thinks that further expansion of services into the upper band “will be dramatically more complex and expensive” this time and will result in significant degradation and interruption of broadcast services.

The association also reacted to arguments by CTIA that compared U.S. spectrum policies to those of China.

“Ensuring the most efficient use of existing spectrum resources should be the FCC’s priority, not maximizing revenue of wireless companies,” NAB wrote.

“The FCC should see through the wireless industry’s transparent and cynical attempt to import generic competitive fears regarding China to this inapposite context.”

The Society of Broadcast Engineers was preparing comments to file as of press time, according to President Ted Hand.

“I assumed this action would come at some point [but it is] a little earlier than I thought,” Hand told Radio World in an email.

Hand says stations have been left with 4000–4200 MHz on which to use for downlinks of live and taped programming, “with most of it being for the radio side,” but there “is a fair amount of programming on Ku band. However, most programming is heading to IP-based delivery.”

Several satellite companies, including SES and ATX, floated migration plans in their comments to the FCC.

They say satellite firms have spent billions on new launches, many of which are only for C-band use. One said this “could result in them becoming space junk way before their lifecycle has concluded.”

SES recommends using only a further portion of the band, possibly up to 100 MHz. They say using the entire 200 MHz of the upper band would require extensive study and planning.

Meanwhile, ATX has proposed only redeploying all of the radio services to the Ku band and internet. It told the FCC that during rain fade service interruptions, programming could switch to internet backup. It said the FCC should finance new receivers for radio broadcasters and their earth stations.

The aeronautics industry says swapping out the upper portion of the C-band for 5G would mean those new services would butt up against the aeronautics band at 4.2 GHz. In fact, the Airline Pilots Association International and other aeronautics groups jointly reminded the FCC that the operating band of radio altimeters sits at 4.2–4.4 GHz. The consortium urged that the FAA and FCC coordinate in any rulemakings.

“Early and ongoing industry and regulator collaboration are essential before any final rules are promulgated,” the aeronautical groups told the FCC.

Mark Johnson of Linkup Communications said on the ABA webinar, “It just feels way too soon for another shift for the C-band. The satellite industry spent billions on the most recent shift in 2020. To do it again this soon would place a burden on everyone, from the satellite companies to broadcasters. Forcing them through another repack seems preposterous.”

Johnson said it is too early to speculate on any kind of reimbursement plan for broadcasters affected by another spectrum swap — if it happens. “It’s still very early in a process that will likely take years to play out.”

If the commission does move ahead, it would open a proposed rulemaking followed by a comment period before final rules and procedures would be adopted.