Credit: Getty Images/Gerardo Mora/Stringer

The massive technical recalibration of iHeartMedia earlier this year — when it shed over 1,000 jobs and moved to a more centralized content distribution system — was viewed by some industry observers as one possible blueprint of commercial radio’s future.

And that was before coronavirus hit the country hard.

This article is about the long-term implications of that reorganization, though such discussions now must carry additional caveats about the unknown impact of the health crisis, over coming weeks as well as years to come.

It’s certain that similarly sized radio broadcast companies were already watching closely to see if iHeartMedia’s cloud-based top-down programming structure would succeed. Now iHeart and every other company is also struggling to adapt to the public health dangers and the economic downturn.

iHeartMedia has said that its new “AI-enabled Centers of Excellence” or network operation centers would allow the company to pivot and embrace the capabilities of artificial intelligence. This doesn’t surprise radio experts since it is in line with corporate America’s love of automation. The company didn’t describe the exact role of the hubs in press releases describing the changes.

The technical modernization allowed the company to eliminate many jobs on the programming side; and in March it was still not clear how many technical and engineering positions were affected. It is possible iHeartMedia has added some podcast producers and data scientists to fill out new digital teams, industry observers say. Those comments preceded fresh news at the end of March that the company would institute furloughs due to the coronavirus and that company head Bob Pittman would not take a salary for the rest of the year.

AI-DRIVEN

iHeartMedia has more than 850 stations and also owns online music service iHeartRadio. It now has a Markets Group organizational structure, which allows for the grouping of clusters of stations that are geographically close and culturally similar, according to a press release.

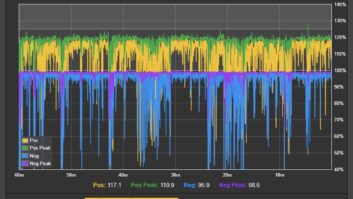

Company officials have declined to speak about specifics, but it appears at least part of the technical modernization is based on a music-mixing AI system offered by Super Hi-Fi, according to Radio World’s previous reporting. The system allows for music to be segued with voice-over capabilities along with other algorithmic options.

“Technology-powered” is how iHeartMedia now characterizes itself, according to a variety of press releases. It plans to use its “unique scale” to take advantage of its position in the audio marketplace.

“The company has made significant technology investments to change everything from how it sells advertising to how it utilizes data and builds new businesses like its digital platform, podcast platform and robust data platform,” it stated in early 2020.

Since the company has been slim on details, Radio World asked several veteran technical observers for their views about what iHeart’s new technical strategy might look like. Though most of them spoke prior to or early on during the disruptions of mid-March, their focus was on longer term anyway.

The most obvious result is that iHeartMedia would likely have little live programming except in its larger markets, they said, looking ahead. AI-enabled Centers of Excellence will program smaller markets. Some markets could be left with only a sales staff and no building.

“The technical consolidation of programming origination on a massive scale, never before seen, might be a possibility,” said one technical observer. “I would further guess that in many smaller and medium-sized markets of iHeartMedia, possibly also in the larger ones that only a sales force would possibly remain.”

The radio industry’s subsequent rush to enable wide-scale telework now would seem likely only to accelerate any such changes.

iHeartMedia, which emerged from Chapter 11 bankruptcy in 2019, revealed little new information about its plans during an earnings call for investors in late February. There was a lot of talk about “de-leveraging balance sheets” and “improving capital structure,” but iHeartMedia executives again gave scant insight into that transformative shift in business operations and jobs cuts.

According to a 10-K filing with the U.S. Securities and Exchange Commission that predated coronavirus, it still had 11,400 employees. The modernization initiatives were expected to deliver $100 million in cost savings by the middle of 2021, according to a financial release.

iHeartMedia said then that it was anticipating real estate expenses to jump this year as it possibly consolidates some broadcast facilities and downsizes others.

But by the end of March the company had withdrawn its full-year fiscal guidance. “iHeartMedia had a strong January and February before the effects of COVID-19 began to unfold into a global pandemic in early March,” it said then. “The challenges that COVID-19 has created for advertisers and consumers has impacted iHeart’s revenue in recent weeks, creating a less clear business outlook in the near term.”

“COOKIE-CUTTER”

Longtime radio observer and iHeartMedia critic Jerry Colliano reported early last month that the broadcaster was at least considering building out “cookie-cutter office and studios” that would be very similar in each market.

“While iHeart tries to negotiate out of leases and/or sell property it owns, according to those familiar with developments, the intention is to create a new build in every city. Presumably that even includes major markets,” Colliano wrote then.

iHeartMedia’s new network operation centers likely consist of management, program origination, commercial and imaging production as well as log preparation and billing, said another industry observer.

“AI in its most basic form has been part and parcel to current program automation systems, music scheduling and log preparation for some time. There will have to be significant expansion and integration to enable (iHeartMedia) to use over a large number of stations,” this expert said.

A sophisticated distribution network would also be essential to the delivery of program content and technical functions, this person said.

Technical monitoring could also be centralized with “virtualization of all studio functions” clearing the way to have a functioning radio station with no studios, according to another technical expert. “The FCC’s deletion of the main studio rule makes such operation possible and entirely legal now,” he said.

Another industry observer said that over time, he suspects there will be many fewer iHeartMedia stations managers and programmers “artfully shaping compelling content” to appeal to a local community.

“They are likely to be replaced with AI distilling local social media to sound as though the station is connected to the community,” he said.

Even local sales teams could be eliminated in some cases and replaced with a more regionalized approach to selling, according to the expert.

There are examples of such a “move to the cloud” with broadcast groups operating stations remotely, he said.

“TV has embraced AI more so, but EMF [Educational Media Foundation] feeds the same programming to all of their local stations and centralizes technical monitoring at their master control facility near Sacramento, Calif. Obviously, iHeart would take this a step farther and use a common facility to produce most if not all programming for multiple local facilities,” the technical expert said. “The result will probably be regional sanitized content.”

DISTANCE NOT AN “ISSUE”

iHeartMedia’s turn toward a more centralized system of program delivery does raise the question of whether the company can improve its bottom line without jeopardizing local ratings in each market, observers said. In fact, financial analysts on February’s earnings call raised the issue of localism and whether the broadcaster’s ratings could be hurt following the earlier staff cuts.

“We don’t think the quality will go down, but rather it will go up. We want the best programming in each market. Distance is no longer an issue in our business, and our ability to project the best talent we have to any location any time is a substantial advantage for us,” said Bob Pittman, chairman and CEO of iHeartMedia.

Pittman mentioned personalities Ryan Seacrest and Bobby Bones and their national syndicated morning shows during the earnings call and remarked about the quality they bring to any radio station.

“We will continue to find those opportunities where we think we can improve quality or create leverage out of great talent,” Pittman said. “To the listeners it is local and we will continue to serve our local communities.”

In addition, Pittman said building music logs and selecting music for each individual iHeartMedia radio station is a lot of work, which can be made easier by using AI to streamline operations.

“Now that we have so much data, the problem is absorbing all that data. By using AI to help us with that, I think it improves the music, and it will free up iHeartMedia programmers to do other things that make radio great, like imaging and promotions. And working with the talent, no matter where the talent is located.”

By the end of March, the business world had changed. But there was no sign of a change in the company’s long-term plan described above. Rich Bressler, the company’s president, COO and CFO, said then, “We fully appreciate the unprecedented challenges posed by this crisis, however, we remain confident in our business, our employees and our strategy. With our experienced management team and our leadership position in the audio sector, we are committed to navigating this period while serving our audiences and other constituents.”